Equity Software Built for Private Equity

Your single source for managing cap tables, MIP plans, running waterfalls and more.

All Your Cap Tables In One Place

Many Private Equity firms struggle to easily report on ownership by entity, transactions, and co-investors. Diligent Equity centralizes your cap tables in one place to make customized analysis of the portfolio easy.

- Simple ownership reporting by entity

- See transactions across your portfolio

- Robust co-investor reporting

Streamline MIP & Option Plans

Creating and managing management incentive and option plans is cumbersome and error prone. Diligent Equity streamlines the creation and administration of these plans, saving your team time and reducing compliance risk.

- Model MIP / Option plans to see potential cap table impact

- Easily generate grant notices and manage vesting schedules

- Auditor ready ASC 718 and disclosure reports

Run Waterfalls in Seconds vs. Hours

Running exit scenarios at different enterprise values can take analysts several hours of manual excel work that is extremely error prone. Diligent Equity allows you to run exit and follow-on models in seconds vs. hours.

- Run waterfalls at multiple EVs

- Easily run follow-on investment impacts on the waterfall

- View waterfall by shareholder or allocation

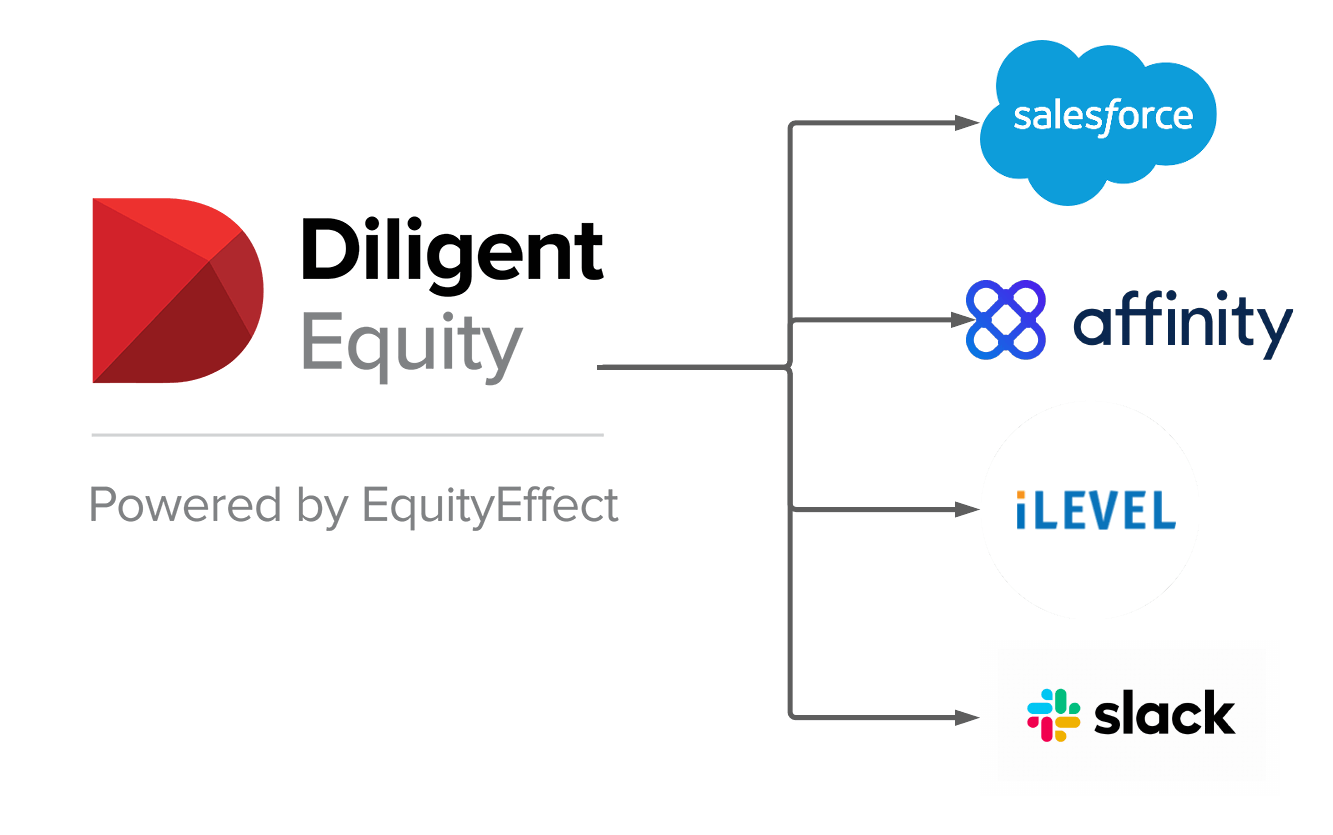

Integrate Data Into Other Key Systems

High-functioning Private Equity firms rely on many key systems, and need data to flow back and forth freely. Our API makes this possible.

- Integrate data and metrics into systems like iLevel, Salesforce, Affinity and Slack.

- Create custom reports like co-investor report or legal term portfolio report.

- Grab historical data by day, week or month to understand trends.