#1 Portfolio Management Software

for Venture Capital

Simple Portfolio management software to make fund tracking easy.

Fund Metrics Dashboarding

Tracking fund performance can be complicated and time consuming for Venture Capital Firms. Diligent Equity makes it easy by centralizing key fund and company data too automatically calculate performance.

- Automatically calculate Gross Multiple, Net Multiple and IRRs

- Track ownership and Valuations across your portfolio companies

- Understand LP contributions and distributions

Centralized Portfolio Company Reporting

Venture Capital firms struggle to easily report on the performance of their portfolio companies. Diligent Equity centralizes your company’s cap tables and performance to make customized analysis of the portfolio easy.

- One-click tear sheets

- Cap Tables and Financial database

- Robust Co-Investor reporting

Run Complex Scenario Analysis In Minutes

Easily understand potential outcomes for your fund and companies and how they impact your funds’ returns. Do all this in minutes vs. hours of spreadsheet work.

- Model fund outcomes taking into account each individual company waterfall

- Run complex waterfall analysis in seconds

- Forecast how investment in a follow-on might impact the fund.

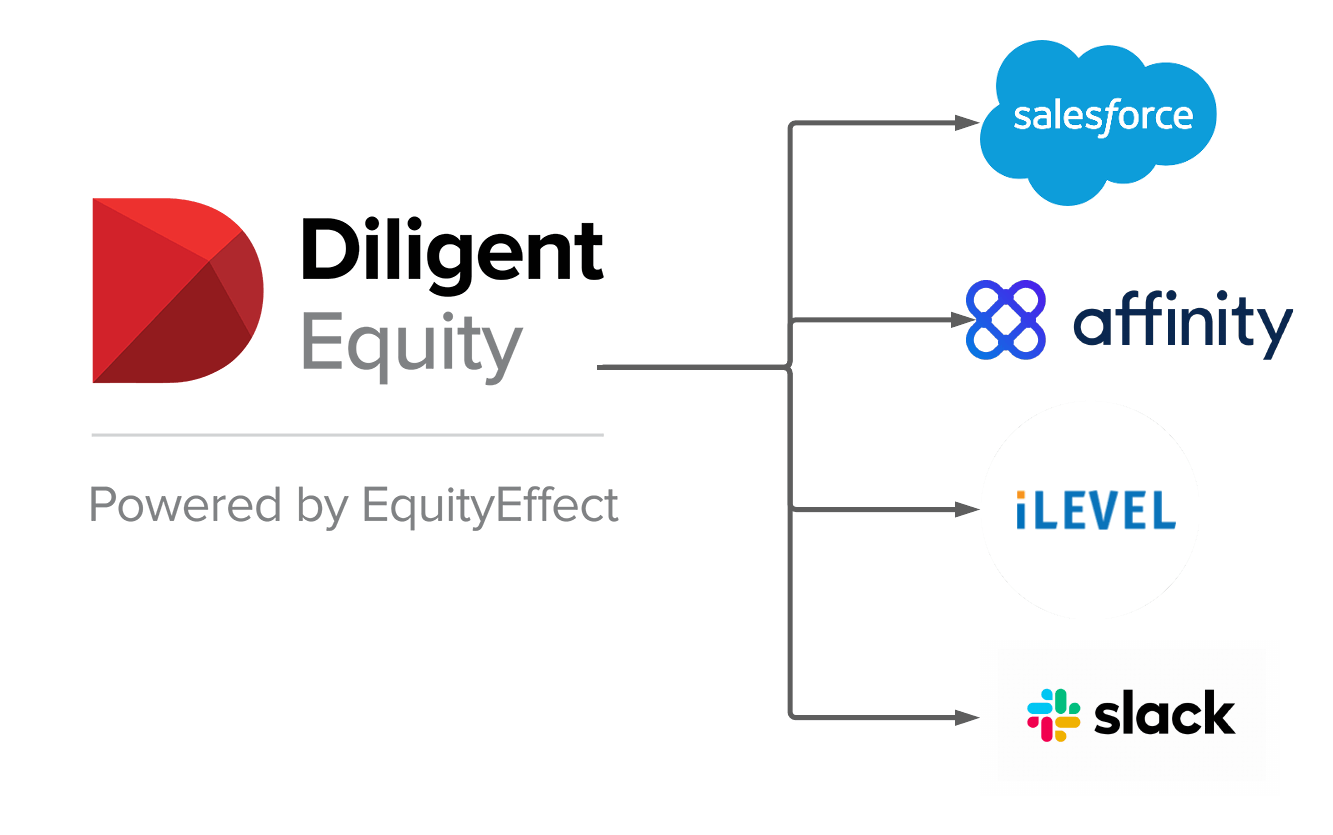

Integrate Data Into Other Key Systems

High-functioning Venture Capital firms rely on many key systems, and need data to flow back and forth freely. Our API makes this possible.

- Integrate data and metrics into systems like iLevel, Salesforce, Affinity and Slack.

- Create custom reports like co-investor report or legal term portfolio report.

- Grab historical data by day, week or month to understand trends.