New Product Release! Best-in-class Fund-level Scenario Modeling

We have all heard that COVID has created a ‘new normal’ over and over. And while it can be exhausting, there are justifications to the claim. Venture capital backed companies are seeing huge shifts in valuations due to changed financial outputs. According to EY the “COVID-19 pandemic means many VC funds are focusing on helping their portfolio companies navigate the crisis, with most expected to delay funding new activities until long-term global economic conditions are clearer.” All these changes are going to have material impact on what the fund is going to return and where funds should be focusing their precious capital to ensure the highest results for their LPs. For all these reasons, we believe scenario modeling should be a key focus for funds in 2020 and 2021. This is why EquityEffect has taken our best-in-class company-level scenario modeling tools and built the most robust fund-level scenario modeling for the Venture Capital market.

Why did we focus on building this?

In previous blog posts, we have gone into more detail on the importance of scenario modeling so I will keep this brief. The discipline of scenario analysis—within a firm or between partners—gives you the opportunity to engage in meaningful discussions about future outcomes, for both the fund and the companies in your portfolio. Even if you can’t predict a singular perfectly-accurate future, debating hypothetical outcomes for companies or funds—over time—can have myriad advantages. These advantages include:

- Improving overall strategy

- Bolstering communication with LPs

- Guiding deployment of capital

- Steering support of portfolio companies

- Ultimately helping VCs become better investors

When speaking to several large and small funds, we regularly got the feedback that funds “wished” they could conduct this practice more often. However, doing this at scale is difficult and labor intensive as many inputs are needed like cap tables, liquidation preferences, anti-dilution provisions along with a complex waterfall tool to process these rules. When extrapolated across and entire portfolio, you can imagine (or probably have had to deal with) how impossible of a task this can seem. That challenge should be a lot less daunting starting today.

How does the new Fund-Level Scenario Modeling tool work?

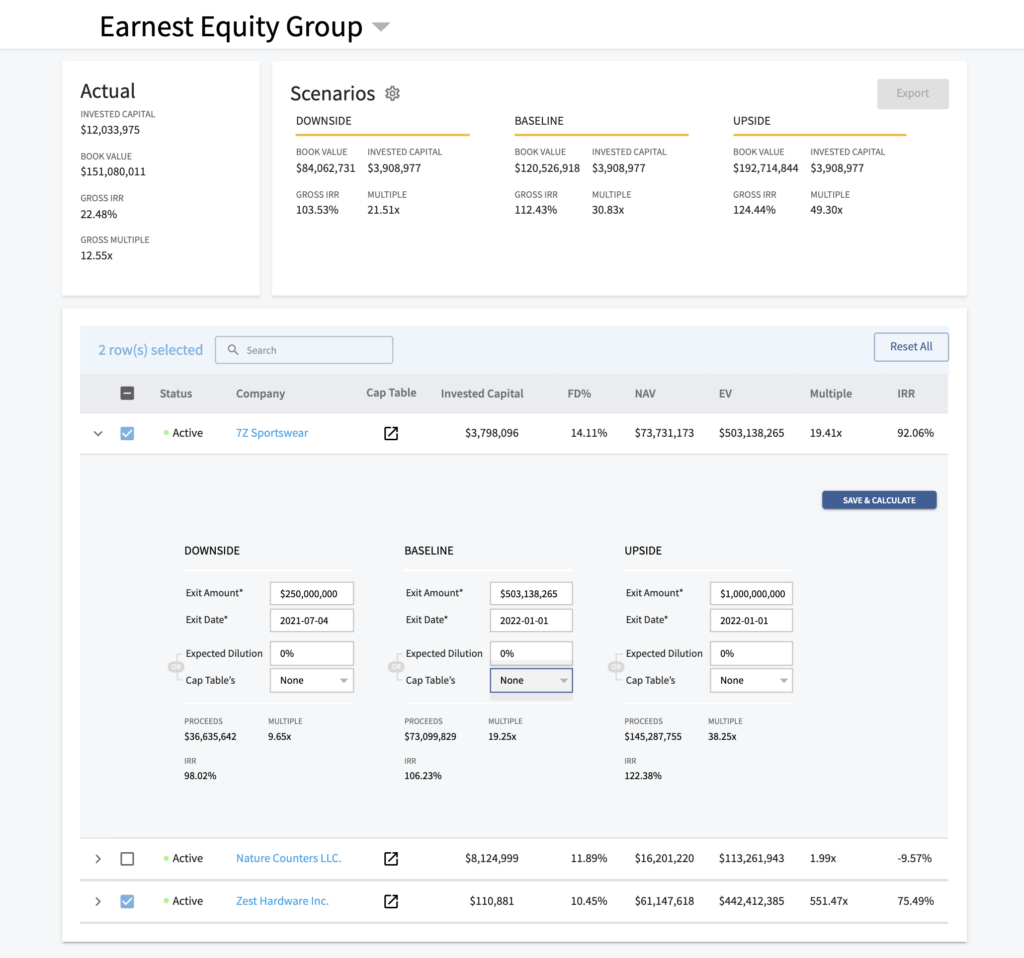

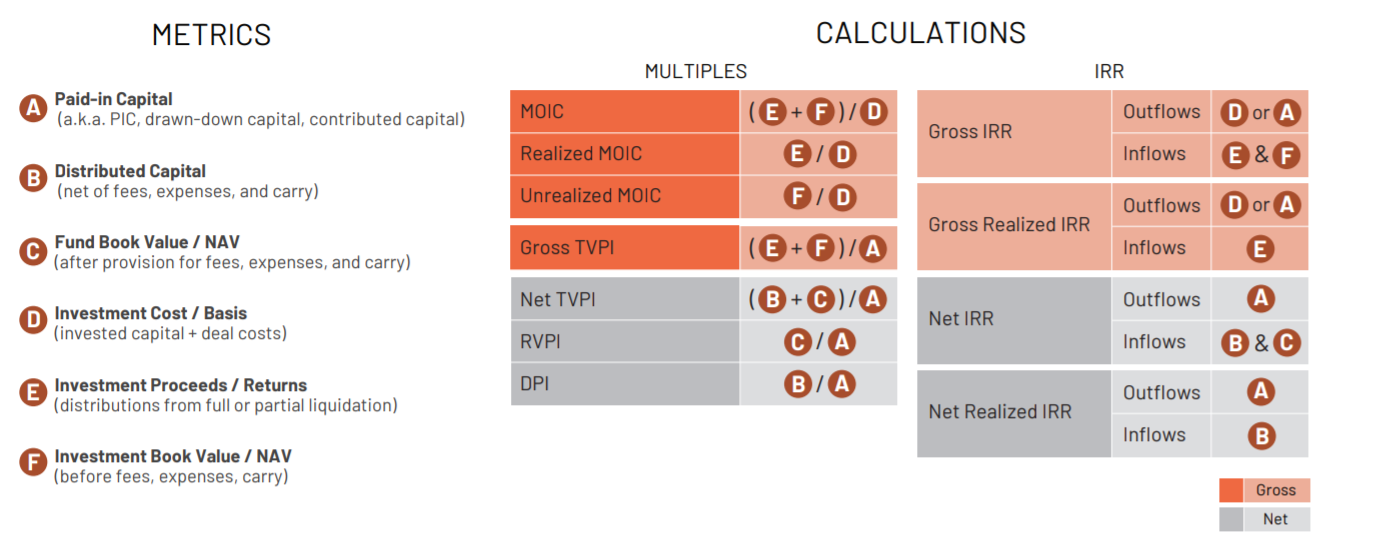

EquityEffect allows Venture Capital firms the ability to centralize their cap tables and deal term information into a single location in our software via our team of paralegals. From there we are leveraging our best-in-class company waterfall engine and surfacing those inputs into a single page where you can model quickly a funds outcome by either inserting assumptions our exit value, date and an expected dilution, or actually pull next-round scenarios from the individual cap tables. The outputs of this will be the calculations for Book Value, Invested Capital, Gross IRR, and Multiple at each company and on the fund-level.

Example use case for the fund-level scenario modeling tool

John, a GP for Labor Day VC, wants to run three separate scenarios for his five-year-old fund, LD Fund II, which has 20 portfolio companies invested in.

Building a Downside, Baseline and Upside Case

The first scenario will be titled “Downside”. This scenario will include the worst-case scenarios for all his portfolio companies: bankruptcies, devaluations, and any other lackluster realized value events. For these companies, John may enter an Exit Amount of $0 for the several companies who went bankrupt, maybe $20,000,000 for one successful exit, and a few other low Exit Amount values for companies who had very small liquidations. The second scenario will be titled “Baseline”. This scenario will include John’s middle-ground predictions that he has provided to his LPs. For these companies, John could enter a higher amount of successful Exit Amounts of around $20,000,000, and maybe even a $100,000,000 exit. The third scenario will be titled “Upside”. This scenario will include the best-case scenarios for all of the portfolio companies. For the Upside scenario, John can be as optimistic as he wants. How about two companies that exited at $250,000,000? No bankruptcies. A perfect fund closure.

Once John has saved these company-level scenarios and the calculations have populated at the fund-level, John can leave and return to edit these valuations and get immediate updates as much as he wants. Never has it been this easy to graph out the future returns of your funds. Whether you are entering research and analytical based numbers, or just using your intuition and seeing where it takes you–EquityEffect Scenarios gives you the power to know the numbers your fund will close with, years ahead of time.

Evaluating Follow-on investments

Deciding on follow-on investments is a core component to being able to model out more successful fund strategy. In our tool, you are able to go model out next rounds (or multiple next rounds) on the company level to add to your scenarios. So, if you want to understand how different size investments in the same company or how following-on with certain companies vs. others affects the fund, you can now do that at scale. Again, you can model in new preferences and anti-dilution assumptions into all of this.

Key Takeaway

We are living in a world of constant change for the foreseeable future. Modeling outcomes on a consistent basis should be part of your reporting strategy to better understand forecasts and plan capital allocation. Learn more about our scenario modeling capabilities or request a demo to see how the new tool works could help you understand your possible fund outcomes and better plan reserves.