How Blue Collective Improved Portfolio Management Using EquityEffect

Who is Blue Collective?

Blue Collective is an investment firm founded in 2014 and based in Brooklyn, New York. The firm specializes in multi-strategy investment and has grown to $100M assets under management with 3 partners and 2 dogs. JJ Kasper, the Co-Founder & Partner, recently decided to centralize their portfolio monitoring and LP reporting into EquityEffect.

What were the biggest problems?

VC’s are on the bleeding edge of technology, yet we frequently do most of our work in Google Sheets or Microsoft Office.

For a small team there was a lot to manage from financial reporting to discovering new interesting deals. JJ Kasper notes that the funny thing is venture capital firms “are on the bleeding edge of technology, yet we frequently do most of our work in Google Sheets or Microsoft Office.” Blue Collective itself was managing its workflow from multiple individual solutions that did not exactly get the job done nor did the solutions speak to each other. Not having a centralized data solution to work out of led to decreased internal efficiency, a lack of trust in their data, and increased cost of doing business. Ultimately, the Blue Collective team spent too much time managing their fund and less time finding new companies to invest in.

How did EquityEffect help solve these issues?

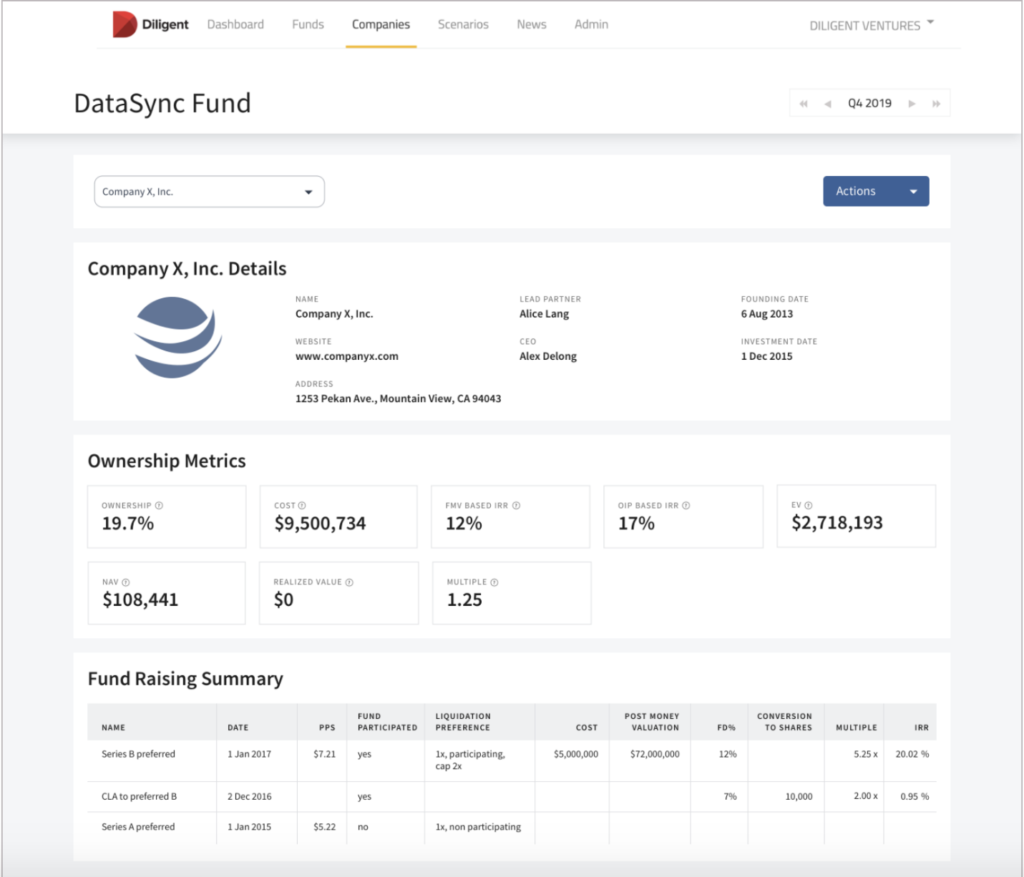

The first thing that the Blue Collective team wanted to solve is to centralize their investment and company performance data. The EquityEffect team went through all deal documents and cap tables to give Blue Collective visibility into the cap table data across all their portfolio companies along with detailed deal information. Then company performance data was layered onto the investment data.

Once this data was centralized, many common workflows were able to be simplified.

Hours Saved Creating Tear Sheets

For example, tear sheet creation had taken Blue Collective hours of manual work to gather the necessary data, validate the accuracy, and style the reporting to share internally and with limited partners. Nnow they can create tear sheets at the click of a button since all data was living and being updated by the EquityEffect team.

Simple and Transparent Fund Reporting to LPs

Gave LPs a clear story that you are on top of your numbers, your information and companies because it is all right there.

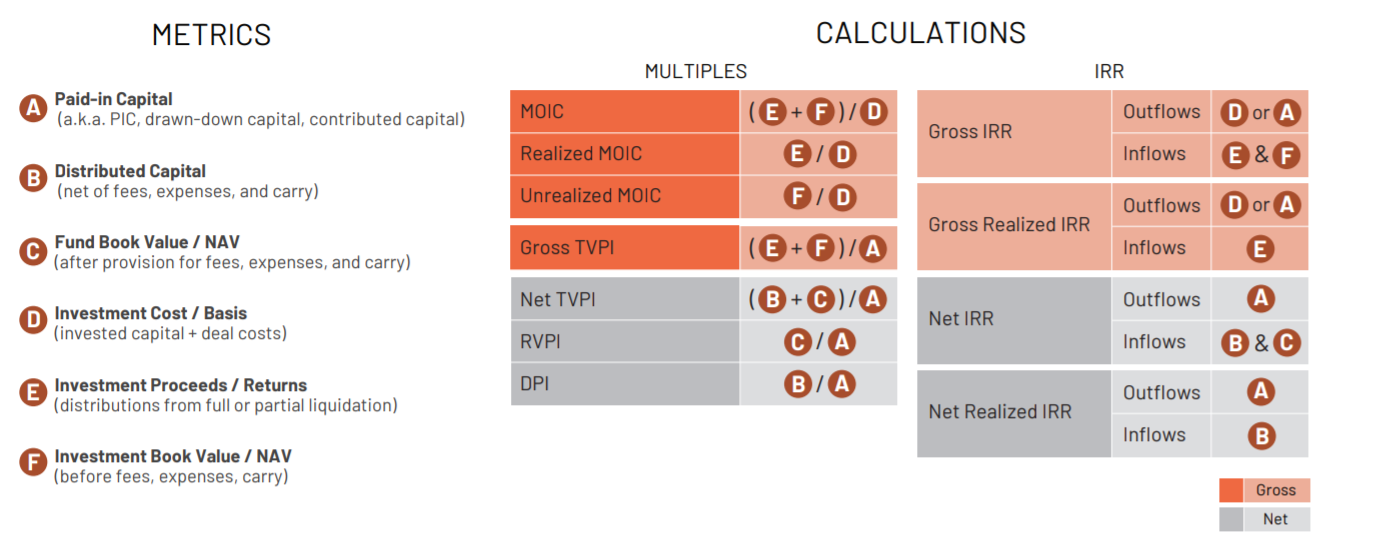

Next, EquityEffect began to work directly with Blue Collective’s fund administrator to add cash flow data. With this information, fund reporting became simple and transparent. This information was added into the LP portal which according to JJ Kasper showed limited partners a “clear story that you are on top of your numbers, your information and companies because it is all right there.”

What was the result?

Blue Collective focuses less time on administrative work and gets to do more of the work they love

Ultimately, the investment in EquityEffect helped Blue Collective save money from multiple systems, increase productivity with simplified workflows to ultimately get to their end goal which Kasper described as being able to be “doing what we are supposed to be doing , finding interesting founders, evaluating companies and investing our dollars.”

If you would like to learn more about EquityEffect, click here to request a demo and see how you can centralize your data and improve your financial reporting.