How Do Convertible Notes Work?

The number of startups has been on the rise for the last few years, and with the vast need for seed financing, many are asking, “How do convertible notes work?”

Despite the global pandemic, over 800,000 entrepreneurs started businesses in 2020. For many of them, convertible notes offer a win-win for founders and investors. Convertible notes are designed specifically for startups in the early stage that have high-growth potential.

We’re explaining what convertible notes are, how they work, and we’ll define the terms you need to know.

What Is a Convertible Note?

Simply put, a convertible note is a form of short-term debt that ultimately converts into equity. Convertible notes are typically issued in conjunction with a future financing round.

There are several advantages to issuing convertible notes. The chief advantage of issuing convertible notes is that founders and investors don’t have to valuate the company until later, as there’s little data to base the company’s valuation in the early stage. Generally, it’s better to valuate the company during the Series A funding round.

Getting Familiar with Convertible Note Terms

We’re defining four key terms to help you understand convertible notes:

- Discount rate – A valuation discount that early investors receive over the rate offered to investors in the subsequent financing round. The intent of the discount is to compensate early investors for carrying additional risk.

- Valuation cap – This figure represents the maximum price that a convertible note converts to equity, which can be a big benefit if the company takes off. A valuation cap provides an additional award for investors willing to bear a strategic risk during a company’s early stage.

- Interest rate – Convertible notes accrue interest on the principal that investors contribute, and that increases the number of shares issued upon conversion.

- Maturity date – This refers to the date the note is due, signaling the company to pay it.

With all terms understood, we’ll take a look at how conversion notes work.

How Do Conversion Notes Work?

Conversion notes work similarly to the way a loan works. Investors loan a sum of money to a startup. Rather than the company repaying investors the principal plus interest, the investor gets a share of equity in the company.

When a conversion note gets issued, it automatically converts into shares of preferred stock after the Series A funding round. The share prices are based on the terms of the note. The terms will outline the due date or maturity date, and they’ll also show the balance due along with interest.

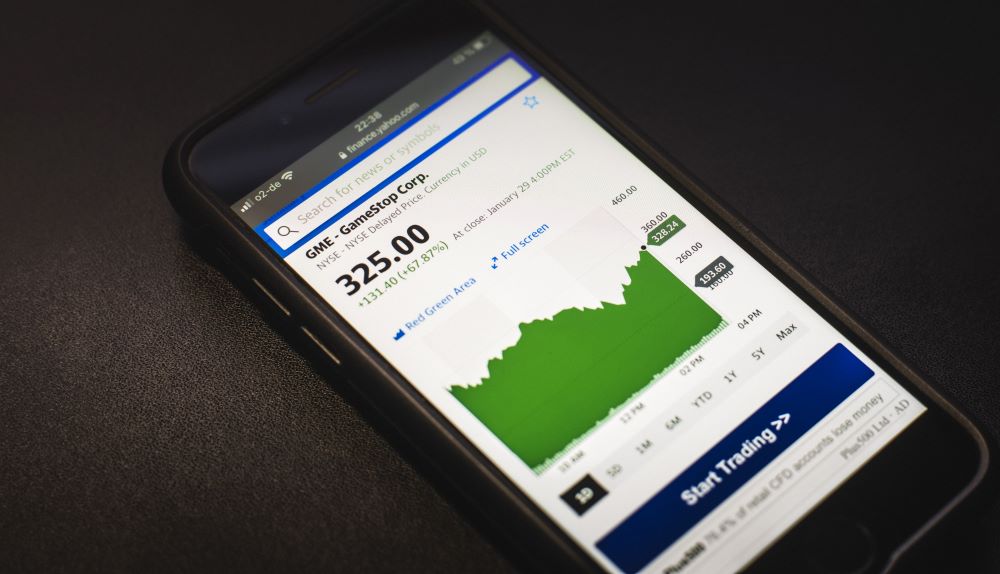

Entrepreneurs that issue convertible notes do so because the company is growing quickly. Convertible notes provide value to investors because it puts them on the short path to a priced round. Investors generally favor getting the debt converted into a security at a heavily discounted price with the hope that a company is on its way to being very successful.

To maximize the potential of convertible notes, companies engage in conversations with potential investors at the angel and seed funding rounds. The valuation is set when they’re ready for the Series A funding round, and there’s no concern over the convertibles.

Managing Conversion Notes on the Maturity Date

Companies that are on a solid growth trajectory don’t always continue growing as expected. That’s where the risk for investors comes in. While investors expect convertible notes to be repaid before the maturity date, there are a couple of options if the maturity date is imminent and the startup hasn’t yet converted the note to equity.

It’s generally worthwhile for companies to extend their loans rather than repay them. In the instance that the company hasn’t yet converted the notes before the maturity date, investors can choose to extend the convertible note’s maturity date with the hope of pushing the company to raise its Series A funding round. Investors might also renegotiate the terms of the conversion note, asking for an increased discount or a lower cap.

Alternatively, investors could ask the company to repay the note in full, complete with interest. Companies that can’t repay the loan will be forced to declare bankruptcy. Bankruptcy doesn’t serve the company or the investors well. By extending the loan, companies have an opportunity to raise a funding round, and investors will have a better chance of getting a return on their investment.

Why Companies Use Convertible Notes

The primary reason startups and investors like convertible notes is because they’re fast and straightforward. Because convertible notes are a type of debt, companies don’t have to go to the trouble of issuing shares of stock. Also, companies performing a typical round of funding for a startup will have to have a valuation performed for the company. Valuations are challenging in the early stage as there’s not enough data to reasonably determine a startup’s worth. With convertible notes, startups can also eliminate the worry over having to make payments to investors as they grow, ensuring a more substantial cash flow.

On the downside, companies that issue convertible notes will eventually be giving some of their equity away. Also, there’s always the risk for investors that a startup won’t be able to raise additional funds and not be able to repay the loan.

Overall, convertible notes work best when both parties agree on a clear plan for success.

Final Thoughts on Using Convertible Notes

The right funding is a crucial part of business growth for all startups. Convertible notes aren’t the best choice for all startups. Under the right circumstances, convertible notes work well for companies and their investors.

Companies that favor other solutions may be able to secure funding via SBA loans, grants, bank loans, or lines of credit. It’s generally best to explore all options for funding and run through scenarios about how they could affect the business positively or negatively.

All in all, convertible notes are beneficial to help startups get off the ground and running. At some point, companies will have to do a valuation of the company. Diligent Equity offers portfolio management software to streamline the process of managing cap tables. When the time comes for valuation, Diligent Equity simplifies what would otherwise be a complex and time-consuming task.